Fannie Mae’s New Policy Empowers Real E

In a groundbreaking move, Fannie Mae, a key player in t...

Commercial real estate (CRE) can be a powerful wealth-building vehicle – but only if you understand how to evaluate deals properly. For newcomers to commercial real estate (CRE), understanding the underwriting process is crucial. It’s the foundation upon which investment decisions are made. However, traditional methods, like complex spreadsheets, often pose challenges, especially for beginners. Entering into the scene, DealWorthIt – a platform designed to demystify underwriting, providing clarity and efficiency for real estate investors.

At its core, underwriting is the process of evaluating whether a property is a good investment. It involves crunching numbers, understanding risks, and making projections based on market data. Key metrics include:

According to Tyler Cauble, a commercial real estate expert, effective underwriting involves analyzing metrics like NOI, Cap Rate, DSCR, and LTV to evaluate a property’s true investment potential.

This perspective simplifies the underwriting process for beginners. It shows that each metric isn’t just a formula — it’s a tool for assessing value, managing risk, and making smarter investment decisions.

Understanding these metrics is vital for making informed investment decisions.

Many investors still use spreadsheets for underwriting – and while spreadsheets are flexible, they come with major downsides:

These problems can be very daunting to commercial real estate investors, especially for newcomers, thus, why it is necessary to have a solution to effectively address them.

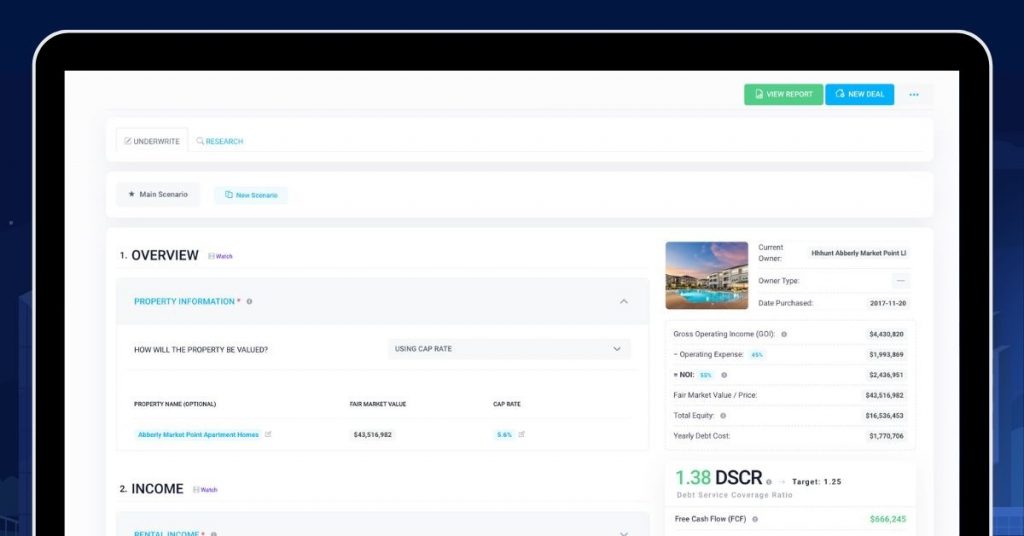

DealWorthIt is designed to solve these exact problems by giving real estate investors a powerful, centralized tool to evaluate deals quickly, accurately, and confidently.

Need to know if a property is worth a closer look? With our Quick Underwriting, you can generate a high-level snapshot of key investment metrics in under 60 seconds – perfect for screening multiple properties quickly.

When it’s time to dive deeper, our Detailed Underwriting feature gives you tools for:

You need not wonder anymore “What does this mean?” or “Did I calculate that right?” DealWorthIt does the math – and shows its work.

Instead of bouncing between sites for tax history, ownership details, market comps, or public records, you can do everything in one place. Our platform continuously updates its formulas, calculators, and data sets – ensuring you’re always working with current insights.

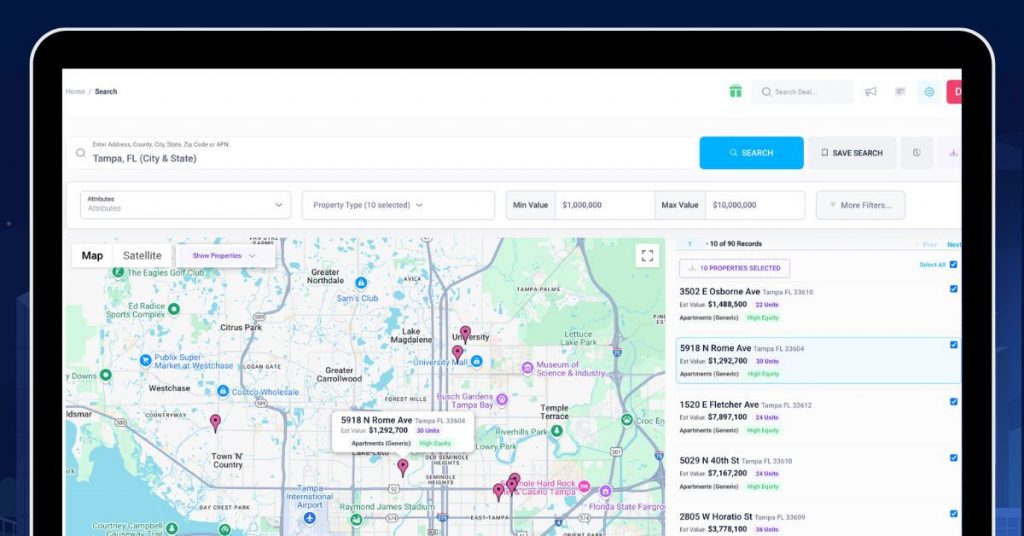

One of DealWorthIt’s most powerful features is the Deal Finder, which gives investors a true edge by offering:

All of this happens within the same platform – no exporting, switching tabs, or chasing down county records.

Commercial real estate underwriting doesn’t have to be complex or time-consuming. With DealWorthIt, new and experienced investors alike can confidently evaluate properties using smart tools, clear metrics, and accurate data – all in one place.

Whether you’re just starting out or scaling your CRE portfolio, DealWorthIt helps you make faster, smarter investment decisions – without spreadsheet headaches.