How to Find the Best Multi-Family Real Estate

Finding the best multi-family real estate deals can be ...

Whether you’re a seasoned real estate investor or just starting out, having a well-crafted real estate exit strategy for your multifamily investment can make the difference between profitability and a missed opportunity. In multifamily real estate, your ability to plan and execute a timely exit can significantly impact the return on investment (ROI) and reduce the risk of financial loss.

This article explores the key strategies for successfully exiting a multifamily investment. We will take you through market timing to sale options, and help you plan for a smooth transition that maximizes your returns and minimizes potential pitfalls. At the end of the article, you’ll have a clear understanding of how to create a successful exit strategy for your multifamily investment, strategies that align with your financial goals, market conditions, and property performance.

An exit strategy is important for your multifamily investments as it helps you plan ahead. Think about the associated risks. A well-thought-out exit strategy allows you to anticipate challenges and capitalize on opportunities. In addition to these, it affords you the time to reduce uncertainty that may arise during volatile market periods. However, you need to have a clear and comprehensive exit strategy as a multifamily real estate investor. Some of the importance of an exit option in real estate are;

After exploring why an exit strategy is important for multifamily investment, the next thing to consider are factors needed to create your exit strategy. And there are several key factors. Your choices will largely depend on market conditions, investment goals, and the financial performance of your property.

You need to understand current economic trends, interest rates, and property values. Changes in the real estate market can impact the price you’re able to sell or may influence your decision to hold the property longer.

Ensure you align your exit strategy with your long-term financial goals. Are you looking to maximize short-term profits, or are you more interested in building long-term wealth through rental income? These are questions you need to answer before creating your exit strategy options.

Evaluate the performance of your multifamily property in terms of Net Operating Income (NOI), cash flow, and capitalization rate. If your property is underperforming, it may be a better option to hold or consider improving the asset before selling.

Now that we have discussed the key factors to consider when creating your exit strategy, it is ripe to delve into the types of exit strategies for multifamily investments you may want to explore to achieve your goals.

There are several exit strategies for multifamily investment, each suited to different types of investors and market conditions. Here are some of the most common multifamily investment exit options:

This is the most straightforward exit strategy. You can consider selling your property. However, timing is sacrosanct. Ideally, you want to sell when property values are high, and the market is strong.

CREXi (Commercial Real Estate Exchange, Inc.) is a leading online platform for commercial real estate listings, transactions, and analytics. It is designed specifically for commercial property owners, brokers, and investors to buy, sell, lease, and manage commercial real estate assets.

LoopNet is one of the largest and most widely used online commercial real estate listing platforms. It is specifically designed for the sale, leasing, and management of commercial properties, including multifamily residential properties, industrial properties, land office buildings, and retail spaces. LoopNet is a key resource for commercial real estate investors, brokers, developers, and tenants.

Spacelist.ca is an online platform designed to help businesses and individuals find commercial real estate properties for lease or sale. It serves as a marketplace where users can browse available spaces across various sectors, including office, industrial, retail, and more. The platform allows property owners, landlords, brokers, and agents to list their available spaces, while businesses and entrepreneurs can use it to search for and evaluate properties based on their needs.

The platform makes it easier for businesses to find commercial real estate without relying solely on traditional brokerage firms. Spacelist helps streamline the leasing process by providing a central hub for real estate transactions and information.

Beach Front Property Management Inc. (BFPMinc) is a well-established property management company specializing in the care and management of residential, vacation, and commercial properties along the scenic and highly sought-after coastal regions of California. With over 15 years of experience, the company offers a comprehensive range of services designed to meet the unique needs of property owners, tenants, and investors.

The company has built a reputation for excellence in the real estate industry, providing both proactive and reactive solutions for beachfront properties. Whether overseeing luxury homes, high-rise condominiums, or commercial retail spaces, Beach Front Property Management Inc. combines in-depth local expertise, top-tier customer service, and cutting-edge technology to ensure the properties they manage achieve optimal performance.

Ascendix Technologies is a leading technology solutions provider specializing in customer relationship management (CRM), real estate technology, and software development. Founded in 2001 and headquartered in Dallas, Texas, Ascendix is recognized for its innovative approach to transforming the real estate and property management industries with custom CRM solutions, mobile applications, and cloud-based technologies.

The company was initially founded with a focus on real estate professionals and organizations, helping them streamline their sales, marketing, and property management processes. Over the years, Ascendix has expanded its services, offering custom CRM solutions that integrate with other business systems and provide actionable insights, helping clients drive efficiency, collaboration, and profitability.

Ascendix Technologies serves a diverse range of clients, from real estate agencies and commercial property managers to enterprises seeking robust CRM systems that can be customized to their needs. Their solutions cater to organizations of all sizes, from small businesses to large corporations.

Wealthbuilder 1031 in one of their publication stated that a 1031 exchange allows you to defer capital gains taxes by reinvesting the sale proceeds into another investment property. This exit strategy is particularly valuable for investors looking to grow their portfolios without incurring large tax liabilities. If you need help with minimizing your real estate tax burden, pay close attention to real estate tax strategies for insight.

Refinancing involves taking out a new loan against your property to pay off the old debt and potentially cash out some equity. This is a viable option for investors looking to maintain ownership but reduce debt or cash out profits. Several lenders specialize in real estate refinancing, and they can help you determine the best time to refinance your multifamily investment.

Some investors prefer to hold onto their multifamily properties for the long term, generating passive rental income and enjoying potential property appreciation. This strategy, Mogul says, is ideal for those seeking steady cash flow and long-term wealth accumulation.

In certain cases, you may choose to sell your stake in the property to a partner. This is often an attractive exit option if you no longer wish to manage the property but still want to remain involved in the deal at a reduced capacity. If you want to use this type of exit strategy for your multifamily investment, it will suit you best if you use firms like:

To maximize profit upon exit in your multifamily investment, use strategic tax planning, time your sale, and optimize your property’s value before listing for sale.

Market cycles play a big role in the timing of your sale. You should aim to sell during a high-demand market to maximize profits.

Minor improvements and renovations, such as upgrading kitchens or enhancing curb appeal, can increase the sale price. A well-maintained, modernized property will attract more buyers and command a higher sale price.

When creating a multifamily exit strategy, best practices demand that you follow these steps.

Step 1: Assess Your Investment Goals and Timeline: Are you looking for a quick profit or a long-term hold?

Step 2: Analyze Current Market Conditions: Monitor local and national real estate trends to understand when is the best time to sell or refinance.

Step 3: Evaluate Your Property’s Financial Health: Review key financial metrics like Net Operating Income and Capitalization Rate to ensure the property is performing well.

Step 4: Choose the Best Exit Strategy: Depending on your goals and market conditions, decide on the most appropriate exit option.

Step 5: Create a Transition Plan: Plan for a smooth transition, whether you’re selling, refinancing, or exchanging properties.

Step 6: Execute and Monitor: Once your exit plan is in motion, stay informed and flexible, adjusting your strategy as needed.

Exiting a multifamily investment can be complex, and many investors make common mistakes that hurt their profits. Here are the common mistakes to avoid when exiting a multifamily investment:

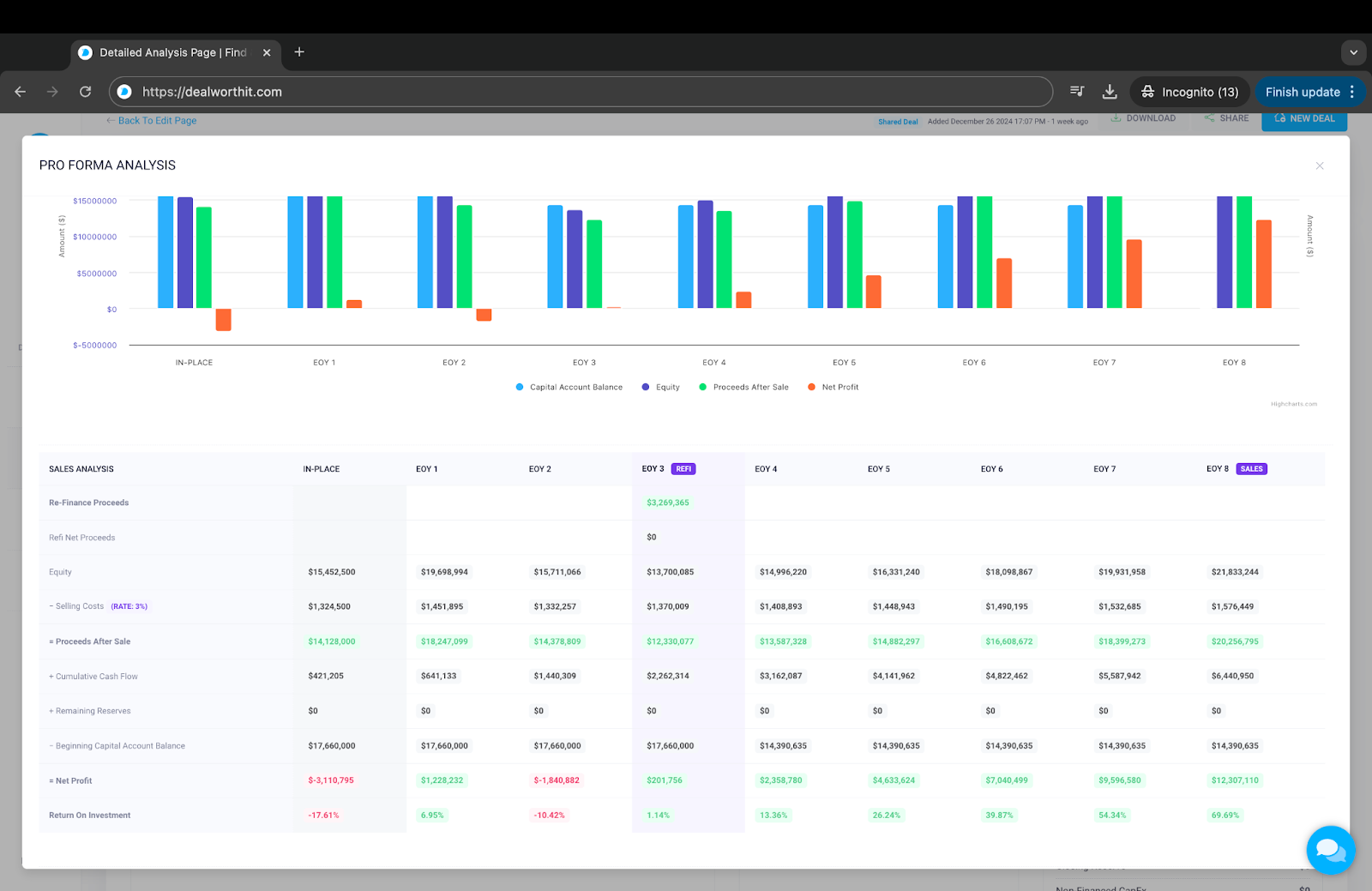

At DealWorthIt, we provide real estate investors with sophisticated Pro Forma analysis tools that can help determine the optimal time to exit a property. Our Pro Forma Analysis helps you forecast the long-term performance of your property, including income, expenses, and cash flow over that period. Detailed projections show the expected returns for each year, allowing you to assess your potential return upon selling your property. With this data, you can make informed decisions about when to sell or whether to continue holding your property for more favorable conditions. Here is how to get started on DealWorthIt to use our Pro Forma Analysis Tools.

This strategy involves timing the sale of a multifamily property to capitalize on a market peak. These types of exits are typically seen in markets with rapidly appreciating property values. An example of a firm that has successfully implemented this multifamily exit strategy is;

Tishman Realty & Construction

This firm, a major player in real estate investment, has used market timing to maximize returns on multifamily properties. Tishman often exits multifamily investments when the market has peaked, securing substantial profits.

The 1031 exchange is a popular strategy among investors who want to defer taxes on the sale of a property by reinvesting the proceeds into a “like-kind” property. Many investors use this strategy to grow their portfolios and avoid paying capital gains taxes. A good of a firm that has used this strategy successfully is;

Marcus & Millichap

Marcus & Millichap is a major brokerage firm specializing in multifamily real estate. They help investors execute 1031 exchanges regularly. Through these transactions, clients can defer taxes and reinvest in more profitable properties.

In conclusion, a well-crafted exit strategy is essential for maximizing returns and minimizing risks in your multifamily investment. By evaluating market conditions, investment goals, and property performance, you can choose the best exit option—whether selling, refinancing, or utilizing a 1031 exchange. Timing, tax planning, and property optimization are key factors in ensuring a profitable exit.

Your strategy should be flexible and adaptable to changing market conditions. You can navigate the complexities of exiting your investment smoothly by avoiding common mistakes, such as underestimating taxes or failing to stay updated on market trends. With the right tools and planning, you can achieve your financial goals and move confidently toward your next investment opportunity.

The best exit strategy depends on your financial goals and market conditions. Common options include selling, refinancing, or utilizing a 1031 exchange to defer taxes and reinvest.

There’s no one-size-fits-all answer, but typically, investors should hold a property for at least 5-10 years to maximize appreciation and minimize capital gains taxes.

While you can’t entirely avoid taxes, a 1031 exchange allows you to defer capital gains taxes by reinvesting the proceeds into another property.