5 Tips for Choosing the Ultimate Real Estate

Real estate coaches play a crucial role in the fast-pac...

Real estate investing has long been considered a stable path to building wealth. But as markets grow more competitive and data becomes more critical, the integration of artificial intelligence (AI) is transforming how investors source, analyze, and close deals. In 2025, AI is no longer a luxury – it’s a necessity for staying ahead.

This article explores how AI is revolutionizing real estate investing, from underwriting to market analysis, and highlights why platforms like DealWorthIt are becoming indispensable.

AI in real estate refers to the use of machine learning, predictive analytics, and automation tools to process large volumes of property and market data. It empowers investors to make faster, more accurate decisions – without needing to manually crunch numbers or spend hours doing due diligence.

According to AppKodes.com “AI in real estate refers to the use of machine learning and data-driven algorithms to automate property analysis, enhance customer experiences, and optimize investment decisions.”

Key technologies include:

Traditional spreadsheets are time-consuming and error-prone. AI tools now deliver instant analysis of potential deals, calculating ROI, IRR, cash-on-cash return, and cap rate – all based on real-time market data.

With platforms like DealWorthIt, investors can upload rent rolls or T12 statements and instantly receive a full underwriting report.

AI models analyze market trends, neighborhood data, and comparable sales to estimate property values with high accuracy. This helps avoid overpaying and improves forecasting for flips or rentals.

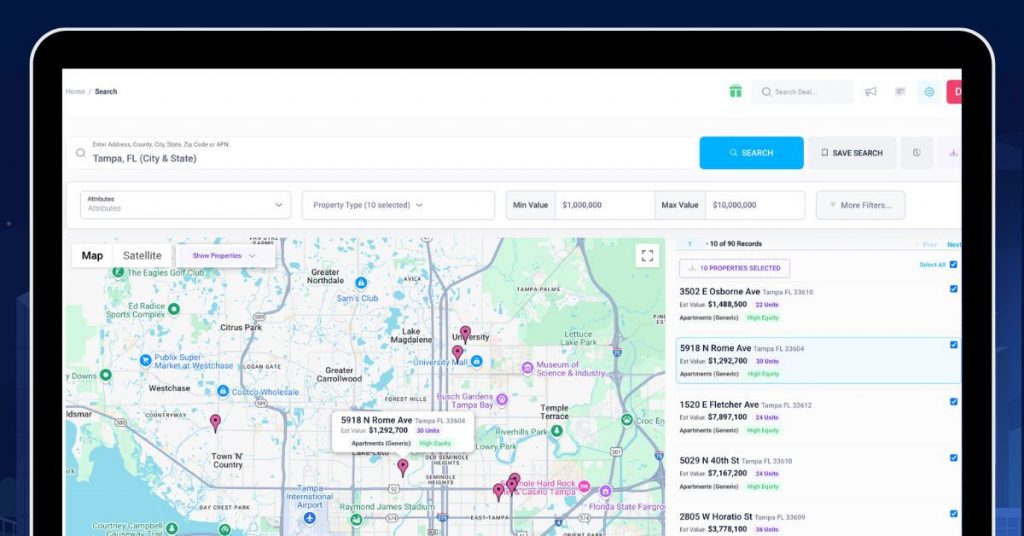

AI scrapes off-market data, owner records, and demographic trends to identify investment opportunities before they hit the MLS. It also scores leads based on the likelihood to sell, motivation, or financial stress signals.

AI flags potential red flags – such as overleveraged properties, declining rent areas, or overestimated ARVs – before a deal is finalized. This saves investors from costly mistakes.

By tracking KPIs and comparing asset performance, AI can recommend hold, refinance, or sell strategies for maximum returns.

Today’s investors face razor-thin margins, fluctuating interest rates, and fierce competition. AI levels the playing field by:

DealWorthIt is a leading example of how AI is streamlining real estate investing. It offers:

With the onboarding of DealWorthIt as your AI in Real Estate Software, Investors can make confident decisions in minutes – not days.

AI is no longer just a buzzword in real estate. It’s the foundation of smarter investing in 2025. Whether you’re analyzing deals, sourcing off-market properties, or building a rental portfolio, AI gives you a massive edge.

Platforms like DealWorthIt are putting AI into the hands of everyday investors. The result? Faster deals, better returns, and fewer mistakes.