Leveraging Data-Driven Insights for Optimal M

In today's competitive real estate market, making infor...

Artificial intelligence is revolutionizing real estate – making property valuation precise and lead generation smarter. Today’s investors, agents, and developers rely on AI-powered tools to analyze market trends, predict values, identify motivated sellers, and enhance outreach. This shift isn’t theoretical; it’s reshaping transaction speed, risk management, and profitability.

In this guide, we’ll explore:

AI in real estate harnesses technologies like machine learning (ML), natural language processing (NLP), computer vision, and predictive analytics. These enable software to aggregate and analyze vast data – ranging from listing prices and rent comps to owner behavior signals and demographic trends.

As DealWorthIt puts it in one of their recent article titled “The Role of AI in Modern Real Estate Investing”:

“Key technologies include: Automated underwriting models; Predictive property valuation; AI-driven lead generation; NLP for documents; Image recognition for property inspections”.

This convergence allows investors to assess properties and contacts in minutes, rather than days, enhancing decision-making speed and accuracy.

Traditional property valuation involves manually searching public records or MLS data to find similar properties (“comps”) that have recently sold. This is time-consuming and highly dependent on the user’s market knowledge. AI eliminates this friction by instantly analyzing thousands of comparable transactions across neighborhoods, ZIP codes, and entire cities.

Platforms like HouseCanary, Zestimate, and DealWorthIt leverage machine learning models trained on massive datasets, including property features (bedrooms, square footage), transaction timing, location trends, and even seasonality. These models learn which factors most influence sale price in specific markets and adjust for outliers, giving a more accurate and unbiased valuation in seconds.

For investors, this means faster deal screening, stronger negotiating power, and confidence in the numbers – all without relying on agents or third-party reports. Automated valuation models (AVMs) now underpin billions of dollars in transactions each year.

Valuation is no longer just about today’s value; it’s about understanding where a neighborhood or asset class is heading. AI tools now use predictive modeling to forecast how a property’s value might evolve over 6-36 months.

By ingesting datasets such as local employment rates, school ratings, retail development permits, transit projects, and buyer sentiment from online behavior, AI can anticipate micro-trends in pricing. For example, if a formerly stagnant area starts seeing increased building permits, rising rents, or low inventory, an AI model might flag it as a growth zone well before the average investor notices.

This helps long-term buy-and-hold investors and flippers position themselves ahead of appreciation, making data-backed decisions on where and when to buy.

Some platforms have incorporated computer vision, where AI evaluates property images (from listings, Google Street View, or walkthrough videos) to identify property condition, deferred maintenance, upgrades, or red flags like:

This feature is particularly valuable for remote investors who can’t physically visit every property. It helps estimate repair costs or rental-grade readiness. Combined with estimated ARV (after-repair value), condition-aware AI scoring streamlines feasibility assessments for value-add strategies.

One of the big questions: Can AI replace appraisers?

While human appraisers are still essential for loans and legal matters, AI-driven AVMs are closing the gap in accuracy. For instance, studies show platforms like Redfin Estimate and HouseCanary align within ±3–5% of licensed appraisals in most markets.

The benefit? AI is consistent, unbiased, and scalable. It doesn’t rely on gut feelings or outdated comps, and it can process thousands of homes simultaneously. Investors can quickly screen dozens of deals without waiting on a manual appraisal or CMA (comparative market analysis).

Lead generation isn’t about collecting names – it’s about finding the right prospects at the right time. AI-enabled lead scoring platforms (like Lindy.ai or InsideSales) track dozens or even hundreds of buyer and seller behaviors in real-time, such as:

These variables feed into a predictive model that ranks each lead by likelihood to convert, saving agents and investors countless hours of cold outreach. Instead of guessing, you’re focused on high-intent leads with statistically verified urgency.

This is where AI transforms deal flow. By scraping and analyzing public and proprietary datasets, AI can identify homes likely to sell before they’re ever listed. These datasets include:

This allows platforms like Catalyze AI or DealWorthIt to deliver fresh off-market leads to investors that would otherwise go unnoticed, unlocking early-mover advantages.

Beyond demographics, AI pulls in behavioral signals to build dynamic profiles of buyers and sellers. This includes social media activity, online ad interactions, property bookmarking, and Google search patterns.

LuxuryPresence, for example, tailors outreach timing and messaging based on these behavioral insights, enabling hyper-personalized email campaigns or ad sequences. The result: higher open rates, better click-throughs, and more appointments booked.

AI also plays a huge role in lead nurturing. Chatbots like ChatPal and Drift now operate 24/7 across listing websites, Facebook pages, and SMS to:

These bots keep your funnel moving while you sleep, ensuring no opportunity slips through.

Platforms like ChatPal use NLP (natural language processing) to hold real-time conversations that feel human. Over time, these bots become smarter, learning user preferences and objections.

Catalyze AI, on the other hand, is designed for commercial and residential investors. It aggregates early-signal data like tax delinquency, eviction filings, or transfer anomalies, and predicts which owners are most likely to sell in the next 90 days.

These tools don’t just generate leads — they create a strategic, efficient acquisition funnel built on intelligence, not intuition

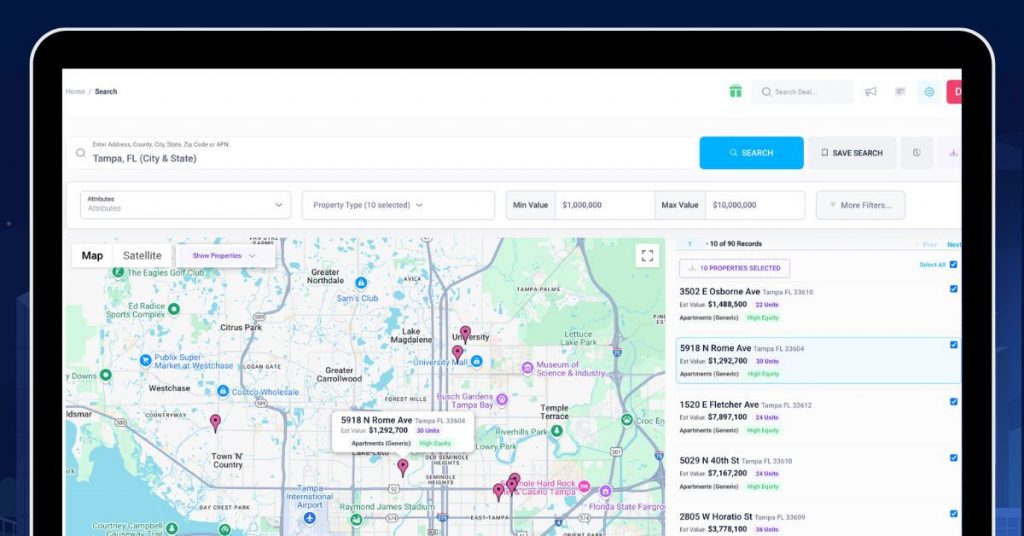

DealWorthIt integrates both valuation and lead-gen into one platform:

Agents are using epique.ai and ValPal to generate listing descriptions, automate marketing copy, and deploy chatbots, boosting lead conversion through targeted messaging.

AI models are only as effective as the data they’re trained and run on. If the inputs, like rent rolls, property tax records, or ownership history, are inaccurate or outdated, the insights will be flawed. This is the classic “garbage in, garbage out” principle. Without trustworthy data, even the most advanced algorithms will yield unreliable results, leading investors to make poor decisions.

To avoid this, investors should prioritize platforms that provide verified, regularly updated datasets. Tools like DealWorthIt emphasize data hygiene by sourcing from reliable databases and cross-referencing public records with third-party sources. Before making decisions based on AI insights, it’s essential to validate that property details, such as square footage, the number of units, and year built, match official records or recent appraisals.

While AI can process vast amounts of data quickly, it isn’t infallible. Unexpected results – such as unusually low property valuations or surprisingly high lead scores – should always be cross-checked using human judgment. Real estate investing requires interpretation of context that an algorithm may miss, especially in complex or rapidly changing markets.

AI tools should be viewed as decision-support systems, not standalone decision-makers. For instance, if a predictive model recommends a Class C property in a declining neighborhood as a top acquisition, an experienced investor might recognize red flags that AI overlooks, such as high tenant turnover or crime statistics. The best results come when AI narrows down the options, and human expertise is used to make the final call.

Collecting and using personal data in real estate, especially for lead generation and direct marketing, demands strict adherence to privacy and data protection laws. AI tools that rely on behavioral data, skip tracing, or automated outreach must comply with global and national regulations to avoid legal issues and maintain public trust.

Investors should ensure the platforms they use are fully compliant with regulations like the General Data Protection Regulation (GDPR) in Europe, the Telephone Consumer Protection Act (TCPA) in the U.S., and the CAN-SPAM Act, which governs commercial email practices. Additionally, always obtain explicit consent when capturing or using personal data. Ethical sourcing not only protects your business legally but also builds long-term credibility with potential sellers and partners.

AI tools offer the most value when they’re embedded into an investor’s daily processes. If a platform requires manual exports, constant logins, or siloed workflows, it reduces speed and increases the risk of human error. Integration is key to realizing the full efficiency gains AI promises.

Solutions like DealWorthIt are designed to plug directly into your CRM, marketing automation tools, and deal pipeline. For instance, a high-quality lead identified by the AI engine can be immediately routed to your email campaign or tagged in your sales system. This enables real-time action without disrupting your existing systems, helping you respond to opportunities faster and stay ahead of the competition.

AI thrives on feedback. The more you test, the smarter your tools become. Investors should consistently experiment with different outreach templates, scoring thresholds, and targeting criteria to improve results over time. Just as you’d A/B test marketing campaigns, your AI workflows deserve similar iteration.

Set aside time each month or quarter to analyze performance metrics such as conversion rates, valuation discrepancies, lead engagement, and deal ROI. Use these insights to adjust your AI configurations and business strategies. Over time, this disciplined feedback loop not only improves your investment outcomes but also customizes your AI tools to your unique market and approach.

AI is no longer optional, it’s essential in modern real estate. It gives investors speed and accuracy in valuations, and empowers agents to source high-converting leads before competitors even see them. From fully integrated platforms like DealWorthIt, which unify underwriting and outreach, to specialized tools offering an edge in copy, visuals, and data analytics, AI is accelerating every stage of the transaction process.

If you’re not leveraging AI yet, you’re leaving opportunity – and profit – on the table. Start by testing one functionality – automated valuations, lead scoring, or chatbot outreach – and scale from there. In a market defined by razor-thin margins and exploding data volumes, AI gives you the strategic leverage to find better deals, make smarter decisions, and close faster.